Mangal Electrical is open for subscription from 20th Aug’25 and closes on 22nd Aug’25. The issue size for the IPO is ₹ 400 Cr which is entirely fresh issue ( ~71.3 lac shares). Price band is set between ₹ 533 & ₹ 561 with the lot size of 26 aggregating to minimum investment for retail investor to ₹ 13746. For small HNI minimum investment is ₹ 2,07,060 and for Big HNI the amount aggregates to ₹ 10,05,720.

Mangal Electrical specializes in transformer components (e.g., laminations, CRGO slit coils, amorphous cores, core and coil assemblies, oil-immersed circuit breakers). The company also trades in CRGO/CRNO coils and amorphous ribbons, manufactures transformers (5 kVA to 10 MVA), and offers EPC services for electrical substations.

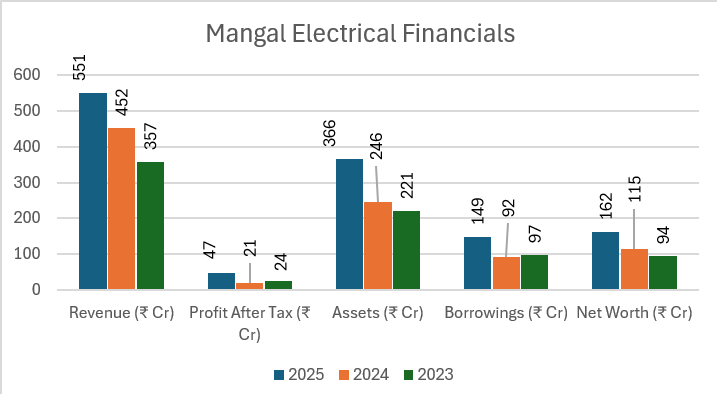

Mangal Electrical Ltd Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit After Tax (₹ Cr) | Assets (₹ Cr) | Borrowings (₹ Cr) | Net Worth (₹ Cr) |

| 2025 | 551 | 47 | 366 | 149 | 162 |

| 2024 | 452 | 21 | 246 | 92 | 115 |

| 2023 | 357 | 24 | 221 | 97 | 94 |

Core Offerings & Store location of Mangal Electrical

Founded in 1990.

Mr. Rahul Mangal (Chairman & MD)

Plant Location of Mangal Electrical

Unit I – VKI Area, Jaipur, Rajasthan

Unit II – VKI Area, Jaipur , Rajasthan

Unit III – Vishwakarma Industrial Area, Jaipur, Rajasthan

Unit IV – Shree Khatu Shyam Ji Industrial Area, Reengus, Sikar, Rajasthan

Unit V – Mahindra World City SEZ Zone (Kalwara Ajmer Road), Rajasthan

Mangal Electrical IPO Strengths & Risks

Strengths:

> Strong Growth in Revenue & Profitability

> Expanding Asset Base & Net Worth

> Diversified Product Portfolio

> Strategic Use of IPO Proceeds in debt repayment, capacity expansion, working capital & corporate purpose

> Industry Tailwinds & Government Push

Risks:

> Fluctuating Profitability

> High Dependence on Power Utilities & Govt Orders

> Rising Borrowings & Leverage Risk

> Industry Cyclicality & Competition

> IPO Valuation & Execution Risk, seems to be a little overpriced

Mangal Electrical: IPO date & invest detail

| IPO Open Date: | 20 August 2025 |

| IPO Close Date: | 22 August 2025 |

| Anchor Investor Bidding | 19 August 2025 |

| IPO Allotment Date: | 25 August 2025 |

| Refunds & Demat Credit: | 26 August 2025 |

| Tentative Listing Date: | 27 August 2025 |

| IPO Category | Enterprise |

| Symbol | MANGALELEC |

| Face Value: | Rs.10 per Equity Share |

| Issue Size: | ~₹400 crore |

| Lot Size: | 26 shares per lot and multiples thereof |

Mangal Electrical Composition & Proceeds

| Fresh Issue: | ~71.3 lac shares |

| Offer for Sale: | – |

| Employee reservation | 1,42,000 shares with ₹53 discount per share |

| Price Range | ₹ 533 to ₹ 561 per share |

| Face Value: | ₹ 10 |

| Debt Repayment | ₹ 96 Crore |

| Working Capital | ₹ 122 Crore |

| Facility Expansion | ₹ 120 Crore |

| General corporate purpose | ₹ 62 Crore |

| IPO Listing on: | NSE & BSE |

| Retail Quota: | ≥ 35% |

| QIB Quota: | ≤ 50% |

| NII Quota: | ≥ 15% |

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | 26 | 1 | 26 | 14,586 |

| Retail (Max) | 26 | 13 | 338 | 1,89,618 |

| Small HNI (Min) | 26 | 14 | 364 | 2,04,204 |

| Small HNI (Max) | 26 | 67 | 1,742 | 9,77,262 |

| Big HNI (Min) | 26 | 68 | 1,768 | 9,91,848 |

Patel Retail Limited IPO Grey market premium

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit |

| 21-Aug | ₹ 561 | ₹ 33 | +Positive | ₹ 594 | ₹ 858 |

| 20-Aug | ₹ 561 | ₹ 30 | +Positive | ₹ 591 | ₹ 780 |

| 19-Aug | ₹ 561 | ₹ 22 | +Positive | ₹ 583 | ₹ 572 |

| 18-Aug | ₹ 561 | ₹ 1 | Neutral | ₹ 562 | ₹ 26 |

| 17-Aug | ₹ 561 | ₹ 1 | Neutral | ₹ 562 | ₹ 26 |

| 16-Aug | ₹ 561 | ₹ 0 | Neutral | ₹ 561 | ₹ 0 |

| 15-Aug | ₹ 561 | ₹ 0 | Neutral | ₹ 561 | ₹ 0 |

| 14-Aug | ₹ 561 | ₹ 0 | Neutral | ₹ 561 | ₹ 0 |

Mangal Electrical Promoters – Pre offer equity (Approx)

Rahul Mangal ~ 41.09%

Ashish Mangal ~ 19.67%

Saroj Mangal ~ 28.37%

Aniketa Mangal ~ 10.24%

To visit Mangal Electrical website click here

For more articles click here