Last updated on November 11th, 2025 at 01:07 am

Anlon Healthcare manufactures Active Pharmaceutical Ingredients & intermediates, supplying to both domestic and international markets. The issue size of the IPO is ₹121.03 crore with all being as book-built fresh issue and no OFS , the price range for the IPO is ₹86–₹91 per share.

Anlon Healthcare is open for subscription from 26th Aug’25 and closes on 29nd Aug’25. The price band is ₹ 86 to ₹ 91/share with the lot size of 164 shares, aggregating to minimum investment for retail investors to ₹ 14,924 considering the upper band.

| Year | 2025 |

| Networth | ₹80.42 Cr |

| Revenue: | ₹120.4 Cr |

| EBITDA | ₹32.3 Cr |

| PAT | ₹20.52 Cr |

| EBITDA Margin: | 26.90% |

| PAT Margin | 17.00% |

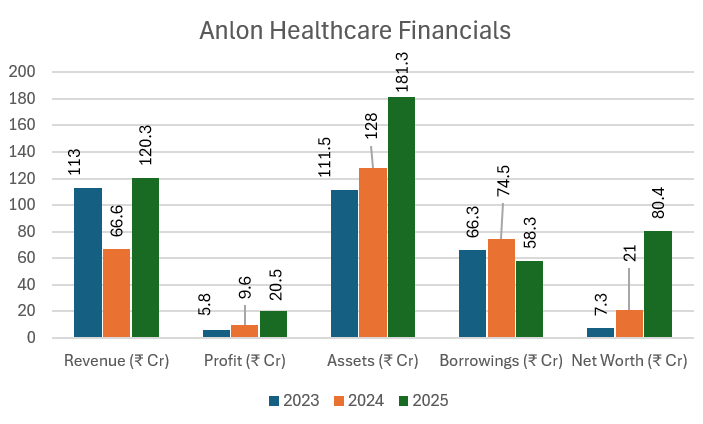

Anlon Healthcare Ltd Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Borrowings (₹ Cr) | Net Worth (₹ Cr) |

| 2023 | 113 | 5.8 | 111.5 | 66.3 | 7.3 |

| 2024 | 66.6 | 9.6 | 128 | 74.5 | 21 |

| 2025 | 120.3 | 20.5 | 181.3 | 58.3 | 80.4 |

Core Offerings & Store location of Anlon Healthcare

Founded in 2013.

Mr. Punitkumar R. Rasadia (Chairman & Managing Director)

Anlon Healthcare is a specialty chemicals and pharmaceutical company engaged mainly in manufacturing & supply of Active Pharmaceutical Ingredients (APIs) and pharmaceutical intermediates, neutraceutical ingredients, personal-care ingredients. It is one of the few Indian companies to develop and supply Loxoprofen Sodium Dihydrate (a widely used anti-inflammatory and analgesic drug API)

Anlon Healthcare has a single manufacturing facility which is located in Gujarat, India. This state-of-the-art manufacturing unit has advanced in-house R&D and quality control laboratories.

Anlon Healthcare IPO Strengths & Risks

Strengths:

> Diverse product basket (65 commercial, 28 at pilot stage & 49 products undergoing laboratory-scale testing. strong pipeline of pilot/lab products)

> Global regulatory presence, DMF approvals from international regulators Brazil (ANVISA), China(NMPA), and Japan(PMDA) supporting exports

> In-house QC/QA & labs, focus on QEHS. Two dedicated manufacturing blocks

> Dedicated API & intermediate blocks with 400 MT per annum installed capacity. Along with filtration, centrifugation & drying systems

> Experienced promoter/management team with domain expertise

Risks:

> Strict audits & inspections by regulatories & customers any audit failures or issues can hit business.

> Revenue concentration in top clients (~77% from top 10 customers), any disruptions in contract renewal, negotiations can impact it.

> High debt-equity ratio (0.73), negative cashflow in each year.

> Regulatory/approval timelines can delay product commercialization.

> Fluctuations is revenue as its saw a big dip in year 2024

Anlon Healthcare: IPO date & invest detail

| IPO Open Date: | 26 August 2025 |

| IPO Close Date: | 29 August 2025 |

| Anchor Investor Bidding | 25 August 2025 |

| IPO Allotment Date: | 01 September 2025 |

| Refunds & Demat Credit | 02 September 2025 |

| Tentative Listing Date: | 03 September 2025 |

| IPO Category | ENTERPRISE |

| Symbol | ANLONHEALT |

| Face Value: | Rs.10 per Equity Share |

| Issue Size: | ~₹121 crore |

| Lot Size: | 164 shares per lot and multiples thereof |

Anlon Healthcare Composition & Proceeds

| Fresh Issue: | ~1.33 Cr shares |

| Offer for Sale: | 0 |

| Employee reservation | Nil |

| Price Range | ₹ 86- ₹91 per share |

| Face Value: | ₹ 10 |

| Debt Repayment | ₹ 5 Crore |

| Working Capital | ₹ 43.15 Crore |

| Facility Expansion | ₹ 30.72 Crore |

| General corporate purpose | Balance |

| IPO Listing on: | NSE & BSE |

| Retail Quota: | ≥ 35% |

| QIB Quota: | ≤ 50% |

| NII Quota: | ≥ 15% |

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | 164 | 1 | 164 | 14,924 |

| Retail (Max) | 164 | 13 | 2,132 | 1,94,012 |

| Small HNI (Min) | 164 | 14 | 2,296 | 2,08,936 |

| Small HNI (Max) | 164 | 66 | 10,824 | 9,84,984 |

| Big HNI (Min) | 164 | 67 | 10,988 | 9,99,908 |

Anlon Healthcare Grey market premium

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit |

| 29-Aug | – | – | – | – | – |

| 28-Aug | ₹ 91 | ₹ 6 | Positive | ₹ 97 | ₹ 984 |

| 27-Aug | ₹ 91 | ₹ 6 | Positive | ₹ 97 | ₹ 984 |

| 26-Aug | ₹ 91 | ₹ 5 | Positive | ₹ 96 | ₹ 820 |

| 25-Aug | ₹ 91 | ₹ 5 | Positive | ₹ 96 | ₹ 820 |

| 24-Aug | ₹ 91 | – | Positive | – | – |

| 23-Aug | ₹ 91 | – | Positive | – | – |

Promoters – Pre offer equity (Approx)

Punitkumar R. Rasadia

Meet Atulkumar Vachhani

Mamata Punitkumar Rasadia

To visit Anlon Healthcare official website click here

For more upcoming IPO’s click here