Patel Retail Ltd, is a supermarket chain operating under the brand Patel’s R Mart, It operates in tier‑III cities and suburban areas in Maharashtra. Patel Retail IPO book build issue is for ₹ 242.76 Cr, With fresh issue of ₹ 217.21 Cr ( ~85 lac shares) and offer for sale aggregating to 25.55 Cr ( ~10 lac shares).

Patel Retail Limited is open for subscription from 19th Aug’25 and closes on 21st Aug’25. The price band is set between ₹ 237 & ₹ 255 with the lot size of 58 aggregating to minimum investment for retail investor to ₹ 13,746. For small HNI minimum investment is ₹ 2,07,060 and for Big HNI the amount aggregates to ₹ 10,05,720.

Patel Retail also exports products like pulses, spices, groceries to more than 35 countries. The company has multiple manufacturing, processing and packaging facilities in Maharashtra, Ambernath & Two production facility in Dudhai (Gujarat)

Core Offering & Store locations of Patel Retail Ltd

Founding Year : 2007–08.

Managing Director Mr. Dhanji Raghavji Patel

No. of Stores: It operates 43 stores across Thane and Raigad as of May 31, 2025, spanning approximately 1,78,946 sq. ft

Core Offerings: A variety of products across food, FMCG, general merchandise, apparel, plus private labels like Patel Fresh, Indian Chaska, Blue Nation, and Patel Essentials.

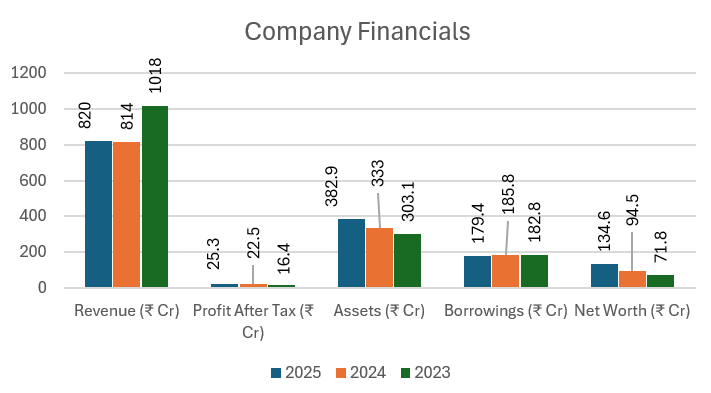

Patel Retail Ltd Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit After Tax (₹ Cr) | Assets (₹ Cr) | Borrowings (₹ Cr) | Net Worth (₹ Cr) |

| 2025 | 820 | 25.3 | 382.9 | 179.4 | 134.6 |

| 2024 | 814 | 22.5 | 333 | 185.8 | 94.5 |

| 2023 | 1018 | 16.4 | 303.1 | 182.8 | 71.8 |

Patel Retail IPO Strengths & Risks

Strengths:

> Strong understanding of product assortment, responds quickly to changing consumer tastes

> Strategic store acquisition & ownership model within proximity to its current location, thus sorting inventory & supply chain

> Robust logistics & distribution network

> Large procurement network of 1500+ farmers

> Credit Rating of Acuite BBB for long term banking facilities and Acuite A3+ for pre/post shipment credit

Risks:

> Concentrated in very limited regions.

> Reduction in revenue from non-retail business due to drop in exports & policy change by govt.

> Negative cash flow in FY’23 & FY’25.

> Large portion of revenue comes from exports, so any change in national/international policies could disrupt business.

> Debt of 179.93 Crore as of May 31, 2025.

Patel Retail Ltd : IPO date and invest detail

| IPO Open Date: | 19 August 2025 |

| IPO Close Date: | 21 August 2025 |

| Anchor Investor Bidding | 18 August 2025 |

| IPO Allotment Date: | 22 August 2025 |

| Refunds & Demat Credit | 25 August 2025 |

| Tentative Listing Date: | 26 August 2025 |

| IPO Category | Enterprise |

| Symbol | PATELRMART |

| Face Value: | Rs.10 per Equity Share |

| Issue Size: | ₹242.76 crore |

| Lot Size: | 58 shares per lot and multiples thereof |

Patel Retail Ltd Composition and Use of proceeds

| Fresh Issue: | 85,18,000 shares |

| Offer for Sale: | Upto 10,02,000 shares |

| Employee reservation | 51,000 shares (up to ₹1 crore) with ₹20 discount per share |

| Issue Type: | 100% Book Building |

| Price Range | Rs. 237 to Rs. 255 per share |

| Face Value: | ₹ 10 |

| Debt Repayment | ₹ 59 Crore |

| Working Capital | ₹ 115 Crore |

| Remaining | General corporate purpose |

| IPO Listing on: | NSE & BSE |

| Retail Quota: | ≥ 45% |

| QIB Quota: | ≤ 30% |

| NII Quota: | ≥ 25% |

| Application Type | Lot Size | No.of Lots | No. of Shares | Investment Amount |

| Retail(Min) | 58 | 1 | 58 | 14,790 |

| Retail (Max) | 58 | 13 | 754 | 1,92,270 |

| Small HNI (Min) | 58 | 14 | 812 | 2,07,060 |

| Small HNI (Max) | 58 | 67 | 3,886 | 9,90,930 |

| Big HNI (Min) | 58 | 68 | 3,944 | 10,05,720 |

Patel Retail Ltd IPO Grey Market Premium

| Date | IPO GMP | GMP Trend | Estimated listing | Estimated profit |

| 21-Aug | ₹ 50 | + Positive | ₹ 305 | ₹ 2,900 |

| 20-Aug | ₹ 50 | + Positive | ₹ 305 | ₹ 2,900 |

| 19-Aug | ₹ 38 | + Positive | ₹ 293 | ₹ 2,204 |

| 18-Aug | ₹ 36 | + Positive | ₹ 291 | ₹ 2,088 |

| 17-Aug | ₹ 36 | + Positive | ₹ 291 | ₹ 2,088 |

| 16-Aug | ₹ 35 | + Positive | ₹ 290 | ₹ 2,030 |

| 15-Aug | ₹ 34 | + Positive | ₹ 289 | ₹ 1,972 |

| 14-Aug | ₹ 34 | + Positive | ₹ 289 | ₹ 1,972 |

| 13-Aug | ₹ 34 | + Positive | ₹ 289 | ₹ 1,972 |

| 12-Aug | ₹ 30 | + Positive | ₹ 285 | ₹ 1,740 |

| 11-Aug | ₹ 26 | + Positive | ₹ 281 | ₹ 1,508 |

To visit Patel Retail Ltd click here

For more articles and to know about us click here.