Last updated on December 2nd, 2025 at 12:53 am

| Check Ardee Eng. DRHP filing with SEBI. | Check Ardee Eng. IPO allotment status |

Ardee Engineering Ltd is a leading engineering and manufacturing company specialized in the designing, fabrication, and installation of industrial equipment and structures catering to other businesses. It claims to provide cost-effective and excellent quality manufacturing. It has its expertise in mechanical, electrical, and civil engineering solutions and serves companies in diverse sectors like power, steel, cement, petrochemical, and infrastructure.

Through the IPO, Ardee will raise ₹ 580 Crore. Out of which the Fresh Issue is around ₹ 500 Crore and Offer for Sale being ₹ 80 Crore.

Subscription date to apply for Ardee Engineering Limited is yet to be announced. Price band for the IPO is also not confirmed yet.

Revenue, PAT, EBITDA of Ardee Engineering Limited

| Year | FY 2024 |

| Networth | ~ ₹ 87.1 Cr |

| Revenue: | ~ ₹ 621 Cr |

| EBITDA | ~ ₹ 60.64 Cr |

| PAT | ~ ₹ 291.05 Cr |

| EBITDA Margin: | ~ 9.74% |

| PAT Margin | ~ 4.67% |

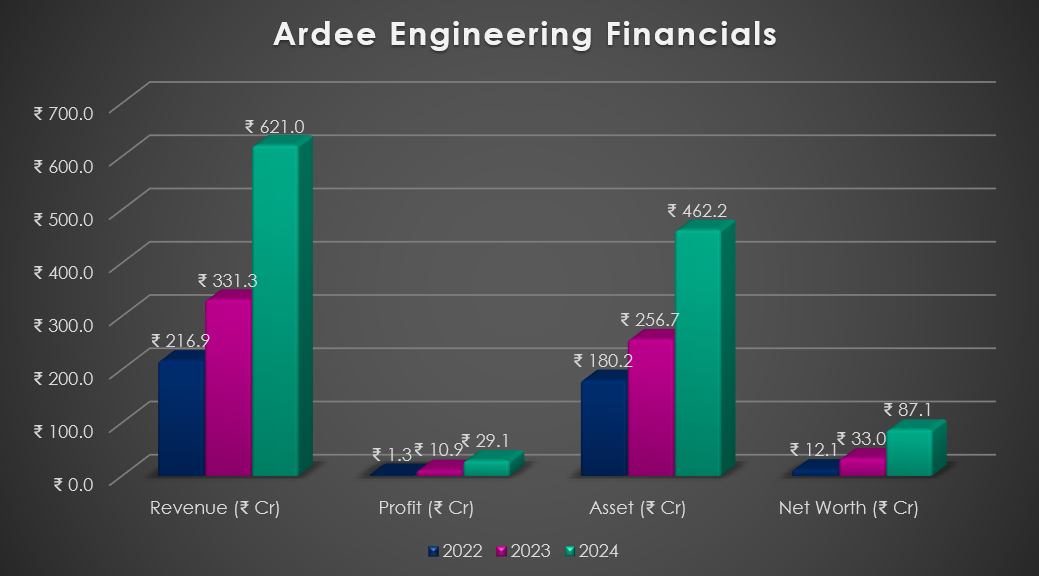

Ardee Engineering Limited Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Net Worth (₹ Cr) |

| 2022 | ₹ 216.9 | ₹ 1.3 | ₹ 180.2 | ₹ 12.1 |

| 2023 | ₹ 331.3 | ₹ 10.9 | ₹ 256.7 | ₹ 33.0 |

| 2024 | ₹ 621.0 | ₹ 29.1 | ₹ 462.2 | ₹ 87.1 |

Ardee Engineering Limited IPO Grey market premium today

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit per lot |

| 23-Nov | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 22-Nov | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 21-Nov | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 20-Nov | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 19-Nov | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

Ardee Engineering Limited IPO Pros & Cons

Strengths:

- Strong Industry Presence: Proven track record in industrial engineering and manufacturing.

- Diverse Client Base: Serves top sectors – power, steel, and infrastructure.

- Robust Financial Growth: Consistent rise in revenue and profitability.

- Expansion Potential: New facilities and automation to boost capacity.

- IPO Proceeds for Growth: Funds earmarked for debt reduction and expansion.

Risks:

- High Sector Competition: Faces rivals in EPC and engineering services.

- Project-Based Revenue: Cash flow depends on large project cycles.

- Economic Sensitivity: Demand linked to capital-intensive industries.

- Working Capital Pressure: High receivables may strain liquidity.

- IPO Valuation Risk: Premium pricing could limit listing gains.

Ardee Engineering Limited: IPO date & invest detail

| IPO Open Date: | Dec 2025 |

| IPO Close Date: | TBA |

| Anchor Investor Bidding | TBA |

| IPO Allotment Date: | TBA |

| Refunds & Demat Credit | TBA |

| Tentative Listing Date: | TBA |

| IPO Category | Mainboard |

| Symbol | |

| Face Value: | Rs. 05 per Equity Share |

| Issue Size: | ₹ 580 Cr |

| Lot Size: | TBA |

Ardee Engineering Limited IPO Composition & Proceeds

| Fresh Issue: | ₹ 500 Crore |

| Offer for Sale: | ₹ 80 Crore |

| Employee reservation | – |

| Price Range | TBA |

| Use of Proceeds: | |

| Borrowing payment | ~ ₹ 65 Cr |

| 2 Manufacturing Facility (at Seetharampur, Telangana) | ~ ₹ 279.6 Cr |

| General Corporate Purpose | Balance |

| 1 Manufacturing Facility (at Parawada, A.P.) | ~ 44.8 Cr |

| IPO Listing on: | BSE – NSE |

| Retail Quota: | ≤ 10% |

| QIB Quota: | ≥75% |

| NII Quota: | ≤ 15% |

Ardee Engineering Limited Lot Size details

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | – | 1 | – | ₹ – |

| Retail (Max) | – | 13 | – | ₹ – |

| Small HNI (Min) | – | 14 | – | ₹ – |

| Small HNI (Max) | – | 66 | – | ₹ – |

| Big HNI (Min) | – | 67 | – | ₹ – |

Core Offerings of Ardee Engineering Limited

Ardee manufactures Pre-Engineered Buildings (PEBs) – design, engineering, manufacturing, erection of steel-structure buildings mostly dedicated to other businesses.

It also has its product portfolio like customised conveyors, processing systems, heavy structural & precision engineering equipment, electrical and instrumentation automation.

Ardee Engineering Limited ‘s customer reach/manufacturing unit

Ardee has five manufacturing units located in Andhra Pradesh and Telangana and has in-house design and engineering team, together provide it with the core capabilities for providing complex engineering solutions to its customers.

It has installed capacity of 44,144 MTPA as of 2024. Ardee’s manufacturing units are vertically integrated to engage to the entire product lifecycle which includes designing, engineering, and manufacturing.

Ardee Engineering Limited Promoters – Pre offer equity (Approx)

| Chandra Sekhar Moturu | ~89.99% |

| Ragdeep Moturu | ~10% |

Lead Managers / Registrars of Ardee Engineering Limited

| Lead / Book Running Lead Managers | IIFL Capital Services Limited, JM Financial Limited |

| Registrar (RTA) | Bigshare Services Private Limited |

Founding Year of Ardee Engineering Limited & Managing Director

Ardee began as a partnership firm in the year 2008.

It was incorporated as a private limited company in the year 2020.

Ardee Engineering Limited FAQ

Q1. What is the business of Ardee Engineering Limited?

Ardee Engineering Limited is an industrial engineering company specializing in pre-engineered buildings, material-handling systems, heavy fabrication, and automation solutions. It serves key sectors like steel, power, infrastructure, logistics, and defence, delivering turnkey engineering, manufacturing, and installation services across India catering mainly to other businesses.

Q2. Why is the company raising funds via IPO?

The IPO aims to fuel growth by expanding manufacturing capacity, reducing debt, strengthening working capital, and supporting long-term projects. It also helps increase brand visibility, improve financial flexibility, and position the company competitively in India’s rapidly growing infrastructure and industrial engineering landscape.

Q3. What is the size of the issue and where will it list?

Ardee Engineering’s IPO is around ₹580 crore including fresh issue and offer for sale. Once approved, the shares will be listed on BSE and NSE.

Q4. What are the risks to an investor?

Key risks include intense industry competition, project-based revenue volatility, capital intensive business, and dependence on other capital-heavy sectors like steel and infrastructure. Any delays in orders, raw-material price swings, or economic slowdown can directly impact margins and profitability.

Q5. What are the potential upsides?

Positive side to invest in the IPO include strong demand for industrial engineering, a growing order book, expanding manufacturing capacity, increasing profitability, and diversified clients across most sectors.

Q6. How to apply for the IPO?

Investors can apply through any broker’s ASBA-enabled online platform. UPI-based IPO application via mobile trading apps, or net banking services. Select the IPO, enter lot size, approve the UPI mandate, and track allotment through the registrar once bidding closes.

Q 7. When is the tentative listing date?

The tentative listing date is expected in early Dec’25. Though exact dates will be announced after SEBI approval and completion of the IPO bidding schedule.

For more amazing blogs click here (IPO Corner).

For the latest upcoming IPO Calendar

For further information you can visit official website of Ardee Engineering