Last updated on November 17th, 2025 at 10:30 am

| Check Fujiyama Power filing with SEBI. | Check Workmates IPO allotment status |

Fujiyama Power Systems Limited, founded in 2017 and incorporated in 2018, is a leading rooftop solar industry company offering comprehensive solar solutions including on-grid, off-grid, and hybrid systems. The company manufactures over 500 majorly including solar panels, inverters, batteries, and EV chargers.

It has strong R&D and manufacturing facilities across India.

The IPO aims to raise funds for capacity expansion, debt repayment, and general corporate purposes.

Fujiyama Power Systems Limited is planning to raise ₹ 828 Cr.

Fujiyama Power Systems IPO subscription opens on November 13, 2025, and closes on November 17, 2025.

Price range for the IPO is ₹ 216-228. The IPO will list on BSE and NSE, with a tentative listing date of November 20, 2025.

The IPO is a book-built issue with a fresh issue size of ₹ 600 Cr and an offer for sale of ₹ 228 Cr shares by promoters

Revenue, PAT, EBITDA of Fujiyama power

| Year | 2025 |

| Networth | ~ ₹ 396.8 |

| Revenue: | ~ ₹ 1550.09 Cr |

| EBITDA | ~ ₹ 248.52 Cr |

| PAT | ~ ₹ 156.34 Cr |

| EBITDA Margin: | ~16.13% |

| PAT Margin | ~10.15% |

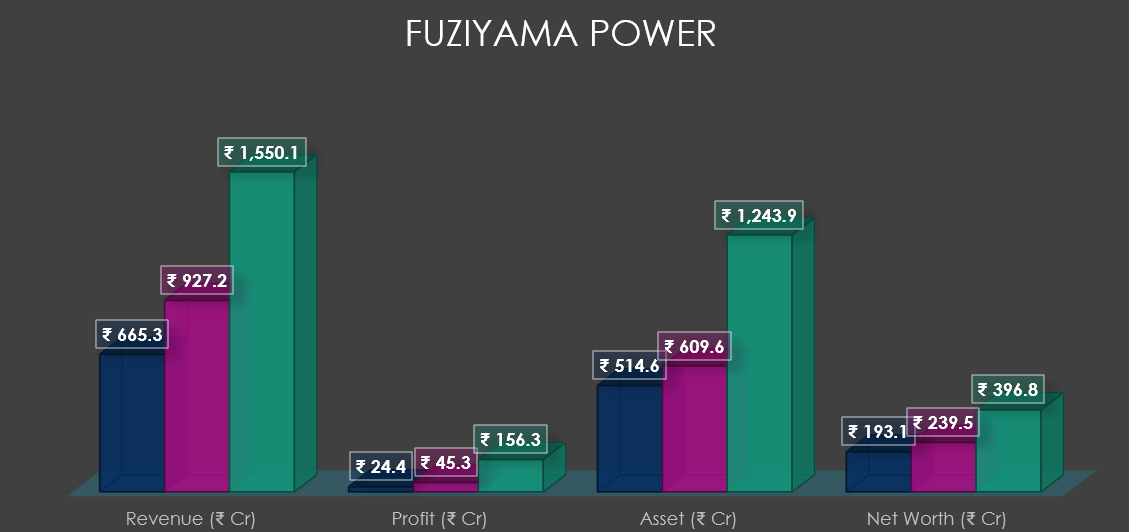

Fujiyama power Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Net Worth (₹ Cr) |

| 2023 | ₹ 665.3 | ₹ 24.4 | ₹ 514.6 | ₹ 193.1 |

| 2024 | ₹ 927.2 | ₹ 45.3 | ₹ 609.6 | ₹ 239.5 |

| 2025 | ₹ 1,550.1 | ₹ 156.3 | ₹ 1,243.9 | ₹ 396.8 |

Fujiyama Power IPO Grey market premium today

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit per 2 lot |

| 16-Nov | ₹ 216-228 | ₹ 05 | No Change | ₹ 233 | ₹ 325 |

| 15-Nov | ₹ 216-228 | ₹ 05 | No Change | ₹ 233 | ₹ 325 |

| 14-Nov | ₹ 216-228 | ₹ 05 | No Change | ₹ 233 | ₹ 325 |

| 13-Nov | ₹ 216-228 | ₹ 05 | No Change | ₹ 233 | ₹ 325 |

| 12-Nov | ₹ 216-228 | ₹ 05 | Positive | ₹ 233 | ₹ 325 |

| 11-Nov | ₹ 216-228 | ₹ 05 | Positive | ₹ 233 | ₹ 325 |

| 10-Nov | ₹ 216-228 | ₹ 05 | Positive | ₹ 233 | ₹ 325 |

| 09-Nov | ₹ 216-228 | ₹ 05 | Positive | ₹ 233 | ₹ 325 |

Fujiyama Power IPO Pros & Cons

Strengths:

- Diversified Portfolio: Offers an extensive range of solar products and solutions such as on-grid, off-grid, and hybrid solar power systems, solar panels, inverters, batteries (lead acid and lithium-ion), UPS systems, and chargers including for E-rickshaws.

- Strong Manufacturing Capabilities: Operates four advanced manufacturing facilities across India, all ISO certified (9001, 14001, 45001), providing large-scale, quality-centric production capacity.

- Technological Innovation: Has a proven track record of product development and innovation with a dedicated R&D team of over 60 professionals and 400 engineers. First in India to develop SMT inverters and combo UPS with advanced features, ensuring future-ready technology offerings.

- Robust Distribution Network: Boasts a pan-India presence with over 725 distributors, 5,546 dealers, and 1,100 exclusive shops, along with strong after-sales and technical support through over 600 qualified engineers.

- Financial Strength: Demonstrated strong revenue growth of 67% and a 245% rise in profit after tax in FY25, with healthy operating margins and return ratios (ROE at 39.4%, ROCE at 41%).

- Experienced Leadership: Supported by experienced promoters and stable senior management with solid industry knowledge and growth execution capability.

Risks:

- Import Dependency: Over 75% of raw materials and components, including crucial items like solar cells and lithium-ion batteries, are imported from China. In case of any geopolitical tensions, supply disruptions, price volatility, and fluctuating import duties can adversely impact profitability and operations.

- Supply Chain Risks: The company relies heavily on third-party suppliers without long-term contracts, making it vulnerable to raw material price fluctuations, quality issues, and supply delays.

- Geographic Concentration: All current manufacturing facilities are located in North India, raising operational risks from regional disruptions such as political, environmental, or logistical challenges until the new Ratlam facility becomes operational.

- Capital Intensive Business: The business requires substantial working capital with a large operating cycle, majorly due to inventory needs for imported materials with long lead times and credit terms with suppliers.

- Market and Product Concentration: A significant portion of revenue comes from solar panels, batteries, and chargers. Any fluctuations in this may adversely impact the business.

- Capital Expenditure Risks: Aggressive capacity expansion plans require substantial investments. Unplanned or delayed capex could strain financials and debt servicing.

- Regulatory and Policy Risks: Solar energy market growth is dependent on supportive government regulations and policies, any change in subsidy rate or norms might impact business directly.

Fujiyama Power: IPO date & invest detail

| IPO Open Date: | 13 Nov 2025 |

| IPO Close Date: | 17 Nov 2025 |

| Anchor Investor Bidding | 12 Nov 2025 |

| IPO Allotment Date: | 18 Nov 2025 |

| Refunds & Demat Credit | 19 Nov 2025 |

| Tentative Listing Date: | 20-Nov’25 |

| IPO Category | Mainboard |

| Symbol | |

| Face Value: | Rs. 1 per Equity Share |

| Issue Size: | ~ ₹ 828 Crore |

| Lot Size: | 65 |

Fujiyama power IPO Composition & Proceeds

| Fresh Issue: | ~ ₹ 600 Crore |

| Offer for Sale: | ~ ₹ 228 Crore |

| Employee reservation | – |

| Price Range | ₹ 216-228 |

| Use of Proceeds: | |

| Repayment of borrowings | ~ ₹ 275-300 Crore |

| Setting new technical Manufacturing plant | ~ ₹ 180 Crore |

| Working Capital Requirement | Balance |

| General Corporate Purpose | Balance |

| IPO Listing on: | BSE – SME |

| Retail Quota: | ≥ 33% |

| QIB Quota: | ≤ 50% |

| NII Quota: | ≤ 15% |

Fujiyama Power Lot Size details

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | 65 | 1 | 65 | ₹ 14,820 |

| Retail (Max) | 65 | 13 | 845 | ₹ 1,92,660 |

| Small HNI (Min) | 65 | 14 | 910 | ₹ 2,07,480 |

| Small HNI (Max) | 65 | 66 | 4,290 | ₹ 9,78,120 |

| Big HNI (Min) | 65 | 67 | 4,355 | ₹ 9,92,940 |

Core Offerings of Fujiyama power

Fujiyama Power Systems Limited offers a comprehensive range of solar energy products and solutions in the rooftop solar industry. Their core offerings include on-grid, off-grid, and hybrid solar inverters, solar panels (mono and polycrystalline), solar PCUs, solar management units, lithium-ion and tubular batteries, online and offline UPS systems, solar charge controllers, and EV chargers.

No. of Stores/Fujiyama power ‘s customer reach/market share

The company operates four manufacturing facilities in Greate Noida, Dadri (U.P.), Parwanoo (H.P.) and Bawal (Haryana).

Fujiyama Power Systems has a strong customer reach and extensive market presence in India with over 1,100 exclusive franchise stores known as “UTL Shoppes,” more than 480 distributors, and approximately 3,600 dealers nationwide.

The company supports its customers with a dedicated team of over 600 qualified service engineers offering maintenance and technical support across regions.

Fujiyama Power Promoters – Pre offer equity (Approx)

| Pawan Kumar Garg | ~ 38.68% |

| Yogesh Dua | ~ 38.68% |

| Sunil Kumar | ~ 4.91% |

Lead Managers / Registrars of Fujiyama power

| Lead / Book Running Lead Managers | Motilal Oswal Investment Advisors Ltd., Angel One, SBI Capital Markets Ltd. |

| Registrar (RTA) | MUFG Intime India Pvt Ltd |

Founding Year of Fujiyama power & Managing Director

Fujiyama Power Systems Limited was founded in 2017.

The Managing Director of the company is Mr. Pawan Garg.

Fujiyama Power FAQ

Q1. What is the business of Fujiyama power?

Fujiyama Power’s core offerings include on-grid, off-grid, and hybrid solar inverters, solar panels (mono and polycrystalline), solar PCUs, solar management units, lithium-ion and tubular batteries, online and offline UPS systems, solar charge controllers, and EV chargers.

Q2. Why is the company raising funds via IPO?

The company is raising funds primarily to set-up new manufacturing plant, including debt repayment being the major use of funds.

Q3. What is the size of the issue and where will it list?

The IPO issue size is approximately ₹ 828 crore and will be listed on the BSE SME platform.

Q4. What are the risks to an investor?

Key risks include procurement, govt. policy affect, competitive market conditions, scale risk, execution risk, and liquidity risk

Q 7. When is the tentative listing date?

Expected listing date is in 20-Nov’25.

For more amazing blogs click here (IPO Corner).

For further information you can visit official website of Fujiyama Power