Last updated on December 2nd, 2025 at 11:47 am

| Check Milky Mist filing with SEBI. | Check Milky Mist IPO allotment |

Milky Mist Dairy Food Ltd is a packaged-food company that specializes in premium value-added dairy products such as paneer, cheese, yogurt, butter, ghee, and ice cream.

It operates with fully automated manufacturing plants and a proprietary logistics network, sourcing milk directly from a large base of farmers to maintain quality and control throughout its supply chain.

Milky Mist is raising money via IPO for the amount of ~ ₹ 2,035 Crore of which Fresh Issue is ~ ₹ 1,785 Crore Offer for Sale of ~₹ 250 Crore.

The subscription date and price range for Milky Mist Dairy Food Ltd’s IPO have not yet been announced but is expected in Dec’25.

Revenue, PAT, EBITDA of Milky Mist Dairy Food Ltd

| Year | Fiscal 2025 |

| Networth | ~ ₹ 242.77 Cr |

| Revenue: | ~ ₹ 2349.50 Cr |

| EBITDA | ~ ₹ 310.34 Cr |

| PAT | ~ ₹ 46.07 Cr |

| EBITDA Margin: | ~13.21% |

| PAT Margin | ~1.96% |

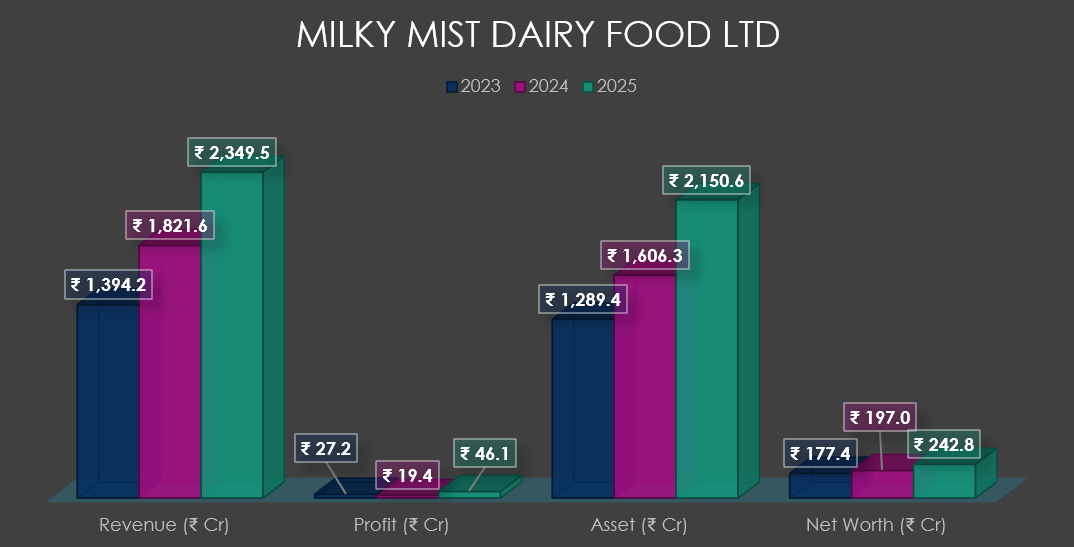

Milky Mist Dairy Food Ltd Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Net Worth (₹ Cr) |

| 2023 | ₹ 1,394.2 | ₹ 27.2 | ₹ 1,289.4 | ₹ 177.4 |

| 2024 | ₹ 1,821.6 | ₹ 19.4 | ₹ 1,606.3 | ₹ 197.0 |

| 2025 | ₹ 2,349.5 | ₹ 46.1 | ₹ 2,150.6 | ₹ 242.8 |

Milky Mist Dairy Food Ltd IPO Grey market premium today

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit per lot |

| 05-Dec | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 04-Dec | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 03-Dec | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 02-Dec | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

| 01-Dec | ₹ TBA | ₹ NA | – | ₹ – | ₹ – |

Milky Mist Dairy Food Ltd IPO Pros & Cons

Strengths:

- Strong brand in value-added dairy products.

- Rapid revenue growth with automated plants.

- Large direct-sourcing farmer network.

- Expanding national retail presence.

- Rising demand for packaged dairy.

Risks:

- Highly competitive dairy market.

- Margin pressure due to milk price volatility.

- Capital-intensive operations.

- Regional concentration risk.

- Dependence on continuous cold-chain efficiency.

Milky Mist Dairy Food Ltd: IPO date & invest detail

| IPO Open Date: | Dec’25 |

| IPO Close Date: | TBA |

| Anchor Investor Bidding | TBA |

| IPO Allotment Date: | TBA |

| Refunds & Demat Credit | TBA |

| Tentative Listing Date: | TBA |

| IPO Category | Mainboard |

| Symbol | |

| Face Value: | Rs. 02 per Equity Share |

| Issue Size: | ~ ₹ 2035 Crore |

| Lot Size: | TBA |

Milky Mist Dairy Food Ltd IPO Composition & Proceeds

| Fresh Issue: | ~ ₹ 1785 Crore |

| Offer for Sale: | ~ ₹ 250 Crore |

| Employee reservation | – |

| Price Range | TBA |

| Use of Proceeds: | |

| Borrowing payment | ~ ₹ 750 Cr |

| Facility expansion | ~ ₹ 414 Cr |

| Equipment purchase | ~ ₹ 129 Cr |

| General Corporate Purpose | Balance |

| IPO Listing on: | BSE – NSE |

| Retail Quota: | ≥ 35% |

| QIB Quota: | ≤ 50% |

| NII Quota: | ≥ 15% |

Milky Mist Dairy Food Ltd Lot Size details

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | – | 1 | – | ₹ – |

| Retail (Max) | – | 13 | – | ₹ – |

| Small HNI (Min) | – | 14 | – | ₹ – |

| Small HNI (Max) | – | 66 | – | ₹ – |

| Big HNI (Min) | – | 67 | – | ₹ – |

Core Offerings of Milky Mist Dairy Food Ltd

Milky Mist Dairy Food Ltd offerings are value-added dairy products like paneer, cheese, curd, ghee, yogurt, UHT products, ice cream, frozen food, ready-to-eat/cook foods, and chocolates.

No. of Stores/Milky Mist Dairy Food Ltd ‘s customer reach/market share

Milky Mist operates 108 exclusive parlours across 8 states.

It holds ~17% market share by value in the organised packaged paneer segment and ~5% in the organised private packaged cheese market nationally.

Milky Mist Dairy Food Ltd Promoters – Pre offer equity (Approx)

| Anitha S | ~51.45% |

| Sathishkumar T | ~40.94% |

Lead Managers / Registrars of Milky Mist Dairy Food Ltd

| Lead / Book Running Lead Managers | JM Financial, Axis Capital, IIFL Capital Services |

| Registrar (RTA) | KFin Technologies |

Founding Year of Milky Mist Dairy Food Ltd & Managing Director

Milky Mist was originally formed in 1999 as a partnership and became a private limited company in 2014.

Mr. T. Sathish Kumar is the MD & Chairman of Milky Mist.

Milky Mist Dairy Food Ltd FAQ

Q1. What is the business of Milky Mist Dairy Food Ltd?

Milky Mist is a value-added dairy company producing paneer, cheese, yogurt, ghee, butter, ice cream, and other packaged foods.

Q2. Why is the company raising funds via IPO?

Milky Mist has plan to repay debt (₹ 750 cr), expand and modernize its Perundurai facility, deploy coolers/freezers, and fund general corporate purpose with the use of IPO funds.

Q3. What is the size of the issue and where will it list?

The IPO size is ₹ 2,035 cr (of which the fresh issue is ~₹ 1,785 cr and OFS for ~₹ 250 cr), and it will be listed on the BSE & NSE platform.

Q4. What are the risks to an investor?

Major risks include heavy debt, milk-price volatility, high competition, small profit margins, execution risk on capex, and heavy dependence on cold-chain.

Q5. What are the potential upsides?

The company has strong growth opportunity in value-added dairy, premium pricing, integrated supply chain, automated manufacturing, and direct sourcing from farmers.

Q6. How to apply for the IPO?

Use your broker or bank’s ASBA facility—apply via UPI/net banking or on your trading platform during the IPO window.

Q 7. When is the tentative listing date?

The tentative listing date is not disclosed yet, but we can expect this to be launched in Dec’25.

For more amazing blogs click here (IPO Corner).

For the latest upcoming IPO Calendar

For further information you can visit official website of Milky Mist