Amanta Healthcare Limited is a pharmaceutical company focused on making sterile injectable fluid products (parenterals – given directly in vein, muscles or body cavity) and medical devices.

The issue Size of the IPO is ~₹126 crore, and all of it being as Offer for sale.

Amanta Healthcare Limited is open for subscription from 01st Sep’25 and closes on 03rd Sep’25.

The price band is ₹ 120 to ₹ 126/share with the lot size of 119 shares, aggregating to minimum investment for retail investors to ₹ 14994 considering the upper band.

| Year – 2025 | |

| Networth | 96.38 Cr |

| Revenue: | 274.7 Cr |

| EBITDA | 40.91 Cr |

| PAT | 10.5 Cr |

| EBITDA Margin: | 14.89% |

| PAT Margin | 3.82% |

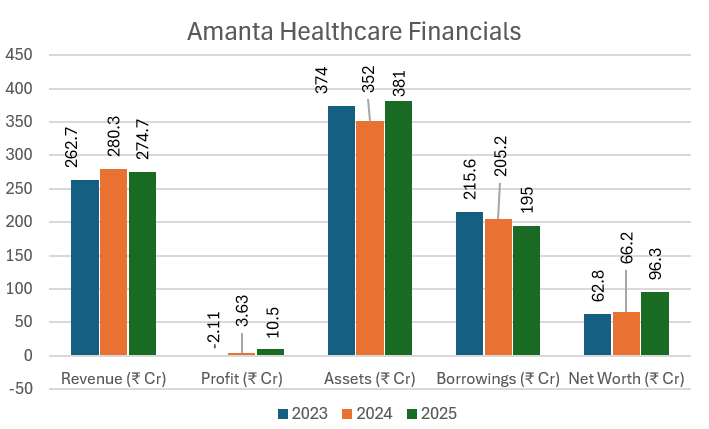

Amanta Healthcare Limited Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Borrowings (₹ Cr) | Net Worth (₹ Cr) |

| 2023 | 262.7 | -2.11 | 374 | 215.6 | 62.8 |

| 2024 | 280.3 | 3.63 | 352 | 205.2 | 66.2 |

| 2025 | 274.7 | 10.5 | 381 | 195 | 96.3 |

Core Offerings & Store/Plant location

Amanta Healthcare is focused on sterile pharmaceutical products and medical devices, mainly:

i) Parenteral Products like Injectables / IV Fluids , glucose, sodium chloride, ringer lactate solution. sterile water and

ii) Medical Devices like IV sets, infusion accessories.

The company operates one integrated manufacturing facility located at Hariyala, Kheda district, Gujarat.And the plant is WHO-GMP and ISO 9001/13485/14001/45001 certified

Amanta Healthcare Limited IPO Strengths & Risks

Strengths:

> Established Track Record since 1994 in sterile pharmaceutical manufacturing, and having strong compliance history.

> WHO-GMP & ISO Certified Facility.

> Focusing on expansion: Use of IPO proceeds for expansion.

> Reducing debt YoY, which is helping to strengthen balance sheet.

> Essential healthcare product so making it recession proof market.

Risks:

> Single Manufacturing Location: operational risk in case of any disruptions.

> Revenue growth is close to ‘0’ i.e., flat revenue growth.

> High promoter holding ~ 61.5%

> Operates in a highly competitive segment and tussle with both Indian and global players.

> Regulatory Dependence: Highly regulated industry, any change in approvals or tighter norms might impact business.

Amanta Healthcare Limited: IPO date & invest detail

| IPO Open Date: | 01 September 2025 |

| IPO Close Date: | 03 September 2025 |

| Anchor Investor Bidding | 29 August 2025 |

| IPO Allotment Date: | 04 September 2025 |

| Refunds & Demat Credit | 05 September 2025 |

| Tentative Listing Date: | 08 September 2025 |

| IPO Category | ENTERPRISE |

| Symbol | AMANTA |

| Face Value: | Rs.10 per Equity Share |

| Issue Size: | ~₹126 crore |

| Lot Size: | 119 shares per lot and multiples thereof |

Amanta Healthcare Limited Composition & Proceeds

| Fresh Issue: | ~1 Cr shares |

| Offer for Sale: | 0 |

| Employee reservation | Nil |

| Price Range | ₹ 120- ₹126 per share |

| Debt Repayment | – |

| Working Capital | – |

| Facility Expansion | ₹ 100.13 Crore |

| General corporate purpose | ₹ 25.87 |

| IPO Listing on: | NSE & BSE |

| Retail Quota: | ≥ 35% |

| QIB Quota: | ≤ 50% |

| NII Quota: | ≥ 15% |

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | 119 | 1 | 119 | 14,994 |

| Retail (Max) | 119 | 13 | 1,547 | 1,94,922 |

| Small HNI (Min) | 119 | 14 | 1,666 | 2,09,916 |

| Small HNI (Max) | 119 | 66 | 7,854 | 9,89,604 |

| Big HNI (Min) | 119 | 67 | 7,973 | 10,04,598 |

Amanta Healthcare Limited Grey market premium

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit (Per lot) |

| 31-Aug | ₹ 126 | ₹ 25 | +Positive | ₹ 151 | ₹ 2,975 |

| 30-Aug | ₹ 126 | ₹ 25 | +Positive | ₹ 151 | ₹ 2,975 |

| 29-Aug | ₹ 126 | ₹ 25 | +Positive | ₹ 151 | ₹ 2,975 |

| 28-Aug | ₹ 126 | ₹ 23 | +Positive | ₹ 149 | ₹ 2,737 |

| 27-Aug | ₹ 126 | ₹ 23 | +Positive | ₹ 149 | ₹ 2,737 |

| 26-Aug | ₹ 126 | ₹ 21 | +Positive | ₹ 147 | ₹ 2,499 |

| 25-Aug | ₹ 126 | ₹ 0 | +Positive | ₹ 126 | ₹ 0 |

Promoters – Pre offer equity (Approx)

Bhavesh Patel ~21.68%

Vishal Patel ~13.55%

Jayshreeben Patel ~3.46%

Jitendrakumar Patel ~12.09%

To visit Amanta Healthcare official website click here

For more amazing articles click here