| Click to check Groww RHP | Check Groww IPO allotment status |

Billionbrains Garage Ventures Ltd. popularly known as Groww is a mobile-first investment platform, offering services such as Stock Broking, Mutual funds, Fixed deposits, Wealth management.

Groww has filed for IPO to raise around ~ ₹6,632 Crore.

Price band for the IPO is expected between ~ ₹95 – ₹100 per share. Grey market premium of Groww today is ₹ 07 showing a neutral to negative trend and sideways market sentiment.

The issue is an Offer for Sale (OFS) ~ ₹5,572 Crore and Fresh Issue of ~ ₹1,060 Crore.

Over the years, it has grown into a trusted name in the wealth management sector with a user base exceeding 12.6 million and a 26.27% market share in retail broking (FY25).

It is backed by prominent investors like Tiger Global, Peak XV Partners (formerly Sequoia India), Ribbit Capital, GIC, and Y Combinator.

Subscription date to apply the IPO starts from 04-Nov to 07 Nov’25.

Revenue, PAT, EBITDA of Groww

| Year | 2025 |

| Networth | ~ ₹5,995.5 Cr |

| Revenue: | ~ ₹4,056 Cr |

| EBITDA | ~ ₹2,306.3 Cr |

| PAT | ~ ₹1,819 Cr |

| EBITDA Margin: | ~ 59.11 % |

| PAT Margin | ~ 44.92 % |

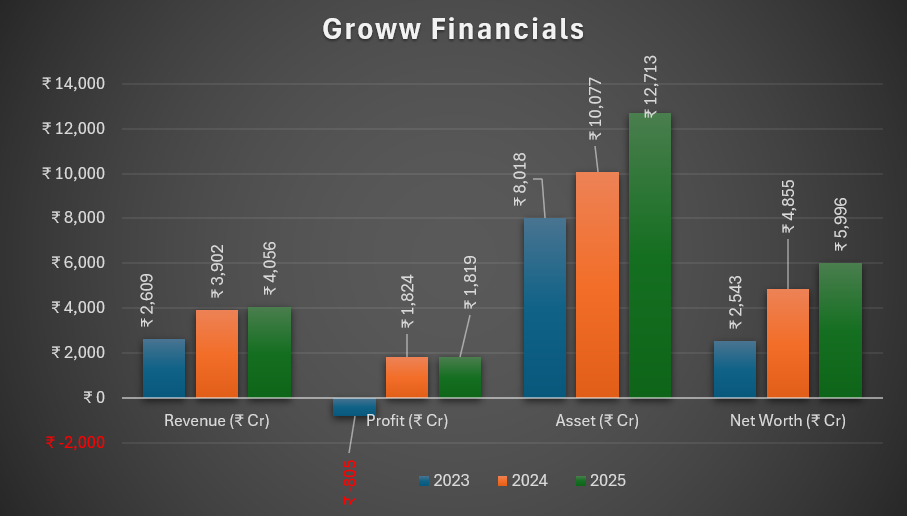

Groww Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Net Worth (₹ Cr) |

| 2023 | ₹ 2,609 | ₹ − 805.45 | ₹ 8,018 | ₹ 2,543 |

| 2024 | ₹ 3,902 | ₹ 1,824 | ₹ 10,077 | ₹ 4,855 |

| 2025 | ₹ 4,056 | ₹ 1,819 | ₹ 12,713 | ₹ 5,996 |

Groww IPO Grey market premium today

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit per lot |

| 12-Nov | ₹ 95-100 | ₹ 07 | Positive | ₹ 107 | ₹ 1050 |

| 11-Nov | ₹ 95-100 | ₹ 05 | Positive | ₹ 105 | ₹ 750 |

| 10-Nov | ₹ 95-100 | ₹ 04 | Positive | ₹ 104 | ₹ 600 |

| 09-Nov | ₹ 95-100 | ₹ 05 | Positive | ₹ 105 | ₹ 750 |

| 08-Nov | ₹ 95-100 | ₹ 05 | Positive | ₹ 105 | ₹ 750 |

| 07-Nov | ₹ 95-100 | ₹ 10 | Positive | ₹ 110 | ₹ 1,500 |

| 06-Nov | ₹ 95-100 | ₹ 14 | Positive | ₹ 114 | ₹ 2,100 |

| 05-Nov | ₹ 95-100 | ₹ 15 | Positive | ₹ 115 | ₹ 2,250 |

| 04-Nov | ₹ 95-100 | ₹ 17 | Positive | ₹ 117 | ₹ 2,550 |

| 03-Nov | ₹ 95-100 | ₹ 15 | Positive | ₹ 115 | ₹ 2,250 |

| 02-Nov | ₹ 95-100 | ₹ 15 | Positive | ₹ 115 | ₹ 2,250 |

| 01-Nov | ₹ 95-100 | ₹ 16 | Positive | ₹ 116 | ₹ 2,400 |

| 31-Oct | ₹ 95-100 | ₹ 16 | Positive | ₹ 116 | ₹ 2,400 |

| 30-Oct | ₹ 95-100 | ₹ 11 | Positive | ₹ 111 | ₹ 1,650 |

| 29-Oct | ₹ 95-100 | ₹ 10 | Positive | ₹ 110 | ₹ 1,500 |

| 28-Oct | ₹ 95-100 | ₹ 12 | Positive | ₹ 112 | ₹ 1,800 |

| 27-Oct | ₹ 95-100 | ₹ 10 | Positive | ₹ 110 | ₹ 1,500 |

Groww IPO Pros & Cons

Strengths:

- Rapid scale and market leadership in retail investing.

- Turnaround to profitability in FY25.

- Strong base and credibility.

- Expansion into wealth management & credit likely to unlock future revenue streams.

Risks:

- Valuation could be aggressive given macro and fintech multiples.

- Regulatory risk in financial services / securities market.

- Competition from existing brokers / fintechs (Zerodha, Upstox, etc.).

- Execution risk in new verticals (credit, lending).

Groww: IPO date & invest detail

| IPO Open Date: | 04 November 2025 |

| IPO Close Date: | 07 November 2025 |

| Anchor Investor Bidding | 03 November 2025 |

| IPO Allotment Date: | 10 Nov’25 |

| Refunds & Demat Credit | 11 Nov’25 |

| Tentative Listing Date: | 12 Nov’25 |

| IPO Category | Mainboard |

| Symbol | – |

| Face Value: | Rs.02 per Equity Share |

| Issue Size: | ~₹ 6,632 crore |

| Lot Size: | 150 |

Groww Composition & Proceeds

| Fresh Issue: | ~₹ 1,060 crore |

| Offer for Sale: | ~₹ 5,572 crore |

| Employee reservation | – |

| Price Range | ₹95-100 |

| Use of Proceeds: | |

| Investment in NBFC subsidiary | ~₹ 205 crore |

| Investment in margin trading subsidiary | ~₹ 167.5 crore |

| Marketing & Brand Building | ~₹ 225 crore |

| Strengthening cloud infrastructure | ~₹ 152.5 crore |

| Inorganic growth by acquisitions and general corporate purposes | Balance |

| IPO Listing on: | NSE & BSE |

| Retail Quota: | ≥ 35% |

| QIB Quota: | ≥ 35% |

| NII Quota: | ≥ 15% |

Groww Lot Size details

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | 150 | 1 | 150 | ₹ 15,000 |

| Retail (Max) | 150 | 13 | 1,950 | ₹ 1,95,000 |

| Small HNI (Min) | 150 | 14 | 2,100 | ₹ 2,10,000 |

| Small HNI (Max) | 150 | 66 | 9,900 | ₹ 9,90,000 |

| Big HNI (Min) | 150 | 67 | 10,050 | ₹ 10,05,000 |

Core Offerings of Groww

Groww offers a broad suite of financial products via its app/website, allowing users to invest/trade in:

i) Stocks (equity)

ii) Mutual funds (direct)

iii) IPOs & ETFs

iv) Derivatives, bonds

v) Margin funding / credit / loan against securities.

It also provides analytical tools, portfolio tracking, research, and investment guidance to retail investors.

Groww’s customer reach/market share

It is among India’s largest retail investment platforms, with ~12.6 million active clients as of June 2025, capturing~26.27% market share in retail broking.

Groww’s Promoters – Pre offer equity (Approx)

| Lalit Keshre | ~9.13 % |

| Harsh Jain | ~6.72 % |

Lead Managers / Registrars of Groww

| Lead / Book Running Lead Managers | JP Morgan India, Kotak Mahindra Capital, Citigroup, Axis Capital, Motilal Oswal |

| Registrar (RTA) | MUFG Intime India Private Limited |

For more amazing blogs click here ( IPO Corner)

For further information you can visit official website of Groww.