| Check Tenneco Clean Air DRHP filing with SEBI. | Check Tenneco IPO allotment status |

Tenneco Clean Air India Ltd manufactures and supplies advanced clean-air, powertrain and suspension solutions for the automotive industry.

It is a highly engineered business catering mostly to OEMs and exports. The company has established its presence in India and has been one among the leader in this segment.

Tenneco is planning to raise around ₹3,000 crore via this IPO. Price range is ₹378 – 397.

Here below are the details about IPO size, price band, grey market premium (GMP), financials, strengths & risks.

The IPO is expected to start from 12th- 14th Nov’25. Grey market premium for Tenneco is currently ₹ 76.

Revenue, PAT, EBITDA of Tenneco Clean Air

| Year | 2025 |

| Networth | ~₹1255.09 Cr |

| Revenue: | ~ ₹ 4890.4 Cr |

| EBITDA | ~ ₹ 815.2 Cr |

| PAT | ~ ₹ 553.1 Cr |

| EBITDA Margin: | ~16.67% |

| PAT Margin | ~11.3% |

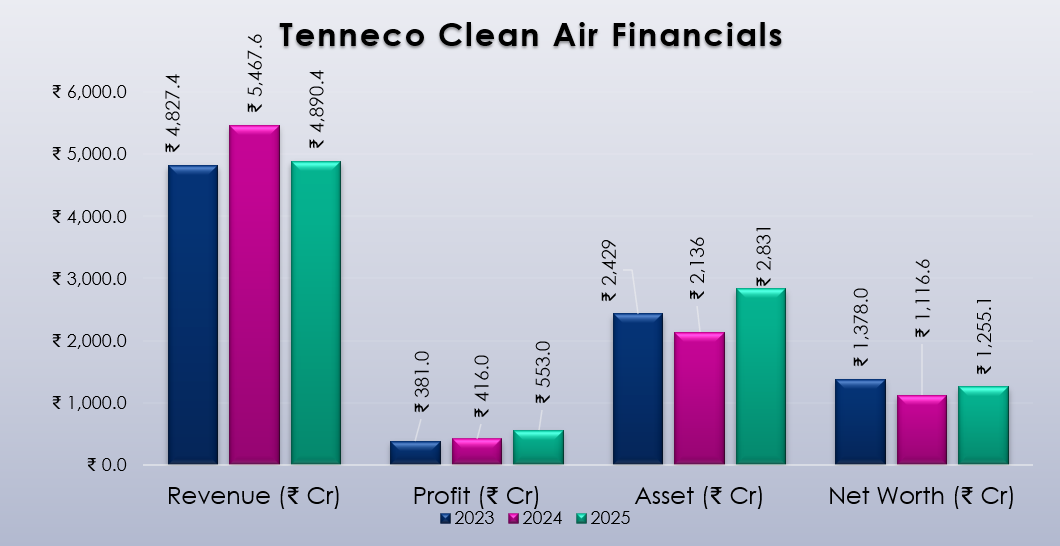

Tenneco Clean Air Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Net Worth (₹ Cr) |

| 2023 | ₹ 4,827.4 | ₹ 381.0 | ₹ 2,429 | ₹ 1,378.0 |

| 2024 | ₹ 5,467.6 | ₹ 416.0 | ₹ 2,136 | ₹ 1,116.6 |

| 2025 | ₹ 4,890.4 | ₹ 553.0 | ₹ 2,831 | ₹ 1,255.1 |

Tenneco Clean Air IPO Grey market premium today

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit per lot |

| 12-Nov | ₹378 – 397 | ₹ 76 | Positive | ₹473 | ₹2,812 |

| 11-Nov | ₹378 – 397 | ₹ 71 | Positive | ₹468 | ₹2,627 |

| 10-Nov | ₹378 – 397 | ₹ 70 | Positive | ₹467 | ₹2,590 |

| 09-Nov | ₹378 – 397 | ₹ 75 | Positive | ₹472 | ₹2,775 |

| 08-Nov | ₹378 – 397 | ₹ 88 | Positive | ₹485 | ₹3,256 |

| 07-Nov | ₹378 – 397 | ₹ 96 | Positive | ₹493 | ₹3,552 |

| 06-Nov | ₹378 – 397 | ₹ 50 | Positive | ₹447 | ₹ 1,850 |

| 05-Nov | ₹378 – 397 | ₹ 70 | Unchanged | ₹463 | ₹ 2590 |

Tenneco Clean Air IPO Pros & Cons

Strengths:

- Strong leadership in clean-air systems for commercial vehicles – ~60% market share in its segment in India.

- Tailwinds from emission-norms, regulatory shifts and clean-air technologies, which favour companies like Tenneco.

- Long history relationships with major OEMs (top passenger vehicle & truck makers) and diversified customer base.

- Operates multiple manufacturing plants (12 across India) which gives scale, supply-chain advantages and local footprint.

- Backed by global parent (Tenneco Inc) and global clean-air/powertrain expertise, which suggests access to advanced technology, global standards and export potential.

Risks:

- The IPO is purely an Offer-for-Sale (OFS) with no fresh funds to be used for the company growth, which is not a very good sign.

- Revenue in the latest financial year has declined (~10%) which may signal near-term headwinds.

- Heavy reliance on certain large customers (top OEMs) – if any one major OEM faces issues, it may impact the company’s business.

- Automotive component business is cyclical and is exposed to vehicle demand downturns.

- Long-term shift towards electric vehicles (EVs) and changing emission technologies may impact the demand for some of the legacy clean-air/powertrain products the company manufactures

Tenneco Clean Air: IPO date & invest detail

| IPO Open Date: | 12 -November 2025 |

| IPO Close Date: | 14-Nov-2025 |

| Anchor Investor Bidding | 11-Nov-2025 |

| IPO Allotment Date: | 15 Nov-2025 |

| Refunds & Demat Credit | 16-Nov-2025 |

| Tentative Listing Date: | 19-Nov’25 |

| IPO Category | Mainboard |

| Symbol | TCAIL |

| Face Value: | Rs. 10 per Equity Share |

| Issue Size: | ~ ₹ 3,000 Cr |

| Lot Size: | 37 |

Tenneco Clean Air IPO Composition & Proceeds

| Fresh Issue: | Nil |

| Offer for Sale: | ~ ₹ 3,000 Cr |

| Employee reservation | – |

| Price Range | ₹ Upcoming ₹ |

| Use of Proceeds: | No utilization |

| Repayment of borrowings | Nil |

| Subsidiary Investment (Growth) | Nil |

| Marketing & Promotions | Nil |

| General Corporate Use | Nil |

| IPO Listing on: | NSE & BSE |

| Retail Quota: | ≥ 35% |

| QIB Quota: | ≥ 35% |

| NII Quota: | ≥ 15% |

Tenneco Clean Air Lot Size details

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | 37 | 1 | 37 | ₹ 14,689 |

| Retail (Max) | 37 | 13 | 481 | ₹ 1,90,957 |

| Small HNI (Min) | 37 | 14 | 518 | ₹ 2,05,646 |

| Small HNI (Max) | 37 | 66 | 2,442 | ₹ 9,69,474 |

| Big HNI (Min) | 37 | 67 | 2,479 | ₹ 9,84,163 |

Core Offerings of Tenneco Clean Air

Tenneco Clean Air India manufactures and supplies clean-air systems, powertrain & suspension products for passenger vehicles, commercial vehicles and off-highway/industrial applications.

No. of Stores/Tenneco Clean Air ‘s customer reach/market share

It operates 12 manufacturing plants across India and serves 119 customers including all top 7 passenger-vehicle OEMs and all top 5 commercial-truck OEMs in India (FY25).

Its market share is approximately 60% for clean-air systems in Indian commercial truck OEMs and about 42% share for off-highway vehicles (not including tractors)

Tenneco Clean Air Promoters – Pre offer equity (Approx)

| Tenneco Mauritius Holdings Limited | ~85.43% |

| Tenneco (Mauritius) Limited | ~6.62% |

| Federal‑Mogul Pty Ltd | ~3.59% |

Lead Managers / Registrars of Tenneco Clean Air

| Lead / Book Running Lead Managers | JM Financial Ltd, HSBC Securities Citigroup Global Markets India Pvt Ltd, Axis Capital Ltd & Capital Markets (India) Pvt Ltd |

| Registrar (RTA) | MUFG Intime India Private Limited |

Founding Year of Tenneco Clean Air

Tenneco established its first manufacturing unit in India (Parwanoo) in 1979.

Mr. Arvind Chandra is currently the CEO & Rishi Verma is the Managing Director of the company.

Tenneco Clean Air FAQ

When will the IPO open & close?

The exact dates are yet to be confirmed but it is expected that the IPO Opens in Nov’25.

What is the face value of the shares?

The face value is ₹ 10 per share

What will the company use the IPO proceeds for?

This is a pure Offer for Sale (OFS) so all the money will go to promoters selling their shares.

Who are the lead managers and registrar

While the registrar is MUFG Intime India Private Limited. Lead Managers are JM Financial Ltd, HSBC Securities Citigroup Global Markets India Pvt Ltd, Axis Capital Ltd & Capital Markets (India) Pvt Ltd.

Which exchanges will it list on?

The IPO is planned for mainboard listing on BSE & NSE (exact symbol to be announced)

What is the business model?

The company manufactures and supplies critical, highly engineered clean-air, powertrain and suspension solutions for OEMs and exports.

What is the issue size?

The issue size is upto ~₹3,000 crore via an Offer for Sale by the promoter

When is the tentative listing date?

Expected listing date is in Nov’25.

For more amazing blogs click here (IPO Corner).

For further information you can visit official website of Tenneco & Tenneco India