Last updated on December 2nd, 2025 at 12:54 am

| Check Waterways Leisure Tourism filing with SEBI. | Check Waterways Leisure IPO allotment status |

Waterways Leisure Tourism Limited (WLTL) popularly known for Cordelia Cruises is a pioneer in delivering luxury cruise holidays designed specifically for Indian travelers. It operates a multi-destination cruise as its brand Cordelia Cruises, WLTL offers premium cruise vacations that blend international standards with Indian preferences in entertainment, cuisine, and hospitality.

It is based out of Mumbai, the company focuses on its niche luxury customers providing safe, comfortable, and memorable experiences. It aims on popularizing cruise tourism in India and establish a vibrant cruise culture in the country.

Waterways Leisure Tourism Limited IPO subscription is expected to launch in Dec’25, exact dates are yet to be announced.

The company has planned to raise ₹727 Crores which is completely a Fresh Issue.

Revenue, PAT, EBITDA of Waterways leisure tourism

| Year | FY 2024 |

| Networth | -₹ 179.5 Cr |

| Revenue: | ₹ 442.1 Cr |

| EBITDA | – ₹ 111.12 Cr |

| PAT | -₹ 119.96 Cr |

| EBITDA Margin: | -0.25% |

| PAT Margin | -0.27% |

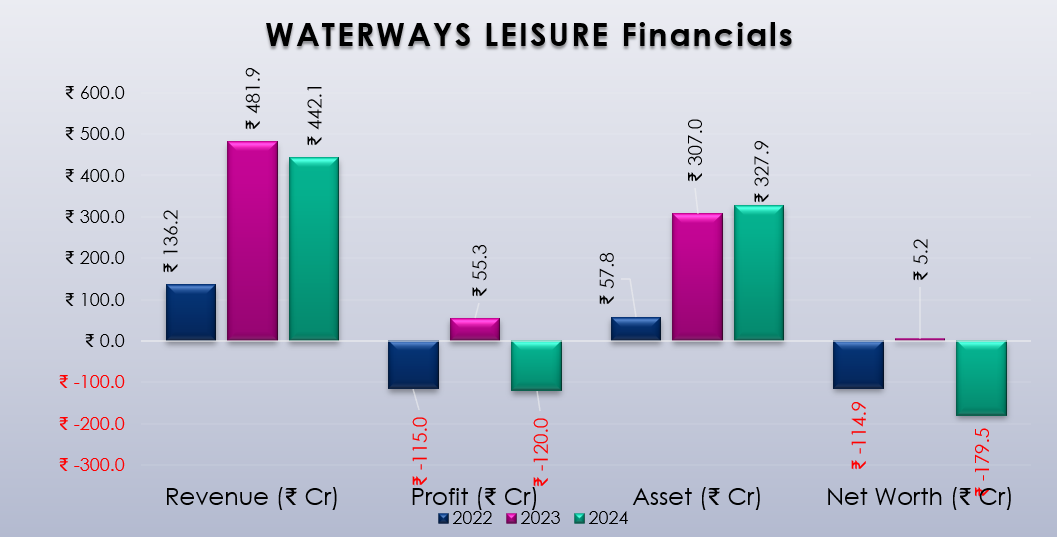

Waterways Leisure Tourism Financials (Consolidated Figures)

| Year (Approx Values) | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) | Net Worth (₹ Cr) |

| 2022 | ₹ 136.2 | –₹ 115.0r | ₹ 57.8 | -₹ 114.9 |

| 2023 | ₹ 481.9 | ₹ 55.3 | ₹ 307.0 | ₹ 5.2 |

| 2024 | ₹ 442.1 | -₹ 120.0 | ₹ 327.9 | –₹ 179.5r |

Waterways Leisure Tourism IPO Grey market premium today

| Date | IPO Price | IPO GMP | GMP Trend | Estimated listing | Estimated profit per lot |

| 22-Nov | ₹ 0-0 | ₹ Not yet | – | ₹ – | ₹ |

| 21-Nov | ₹ 0-0 | ₹ – | – | ₹ – | ₹ |

| 20-Nov | ₹ 0-0 | ₹ – | – | ₹ – | ₹ |

| 19-Nov | ₹ 0-0 | ₹ – | – | ₹ – | ₹ |

| 18-Nov | ₹ 0-0 | ₹ – | – | ₹ – | ₹ |

Waterways Leisure Tourism IPO Pros & Cons

Strengths:

- Operates India’s first multi-destination premium cruise line, Cordelia Cruises, catering to a niche luxury market.

- Fresh issue IPO with substantial planned investment in fleet expansion and lease payments, indicating growth plans.

- Strong promoter backing and strategic focus on enhancing cruise tourism in India.

- Positive investor interest, with allocation for QIBs, non-institutional investors, and retail investors.

Risks:

- Limited operating history as the company was founded recently in 2020.

- Negative PAT margins indicate initial investment phase losses and high operational costs.

- Cruise tourism in India is still a developing sector with variable demand and regulatory uncertainties.

- Market competition from established international cruise lines may impact pricing power.

Waterways Leisure Tourism: IPO date & invest detail

| IPO Open Date: | Dec 2025 |

| IPO Close Date: | TBA |

| Anchor Investor Bidding | TBA |

| IPO Allotment Date: | TBA |

| Refunds & Demat Credit | TBA |

| Tentative Listing Date: | Dec 2025 |

| IPO Category | Mainboard |

| Symbol | |

| Face Value: | Rs. 10 per Equity Share |

| Issue Size: | ~₹ 727 Crore |

| Lot Size: | TBA |

Waterways Leisure Tourism IPO Composition & Proceeds

| Fresh Issue: | ~ ₹727 Crore |

| Offer for Sale: | ~ ₹ 0 Crore |

| Employee reservation | – |

| Price Range | TBA |

| Use of Proceeds: | |

| Lease rental, monthly lease payments to step-down subsidiary | ~ ₹ 552.53 Cr |

| Working Capital Requirement | ~ ₹ 0 Cr |

| General Corporate Purpose | Balance |

| Technology & Infrastructure | NA |

| IPO Listing on: | BSE – NSE |

| Retail Quota: | ≥ 35% |

| QIB Quota: | ≤ 50% |

| NII Quota: | ≤ 15% |

Waterways Leisure Tourism lot size details

| Application Type | Lot Size | No. of Lots | No. of Shares | Investment Amount |

| Retail(Min) | TBA | 1 | TBA | ₹ – |

| Retail (Max) | TBA | 13 | TBA | ₹ – |

| Small HNI (Min) | TBA | 14 | TBA | ₹ – |

| Small HNI (Max) | TBA | 66 | TBA | ₹ – |

| Big HNI (Min) | TBA | 67 | TBA | ₹ – |

Core Offerings of Waterways leisure tourism

It operates primarily in the cruise tourism sector with its flagship brand Cordelia Cruises.

Their core offerings include premium multi-destination cruise experiences along major domestic coastal destinations like Mumbai, Goa, Kochi, Chennai, Lakshadweep, Visakhapatnam, and Puducherry.

Waterways leisure tourism Promoters – Pre offer equity (Approx)

| Rajesh Chandumal Hotwani | 100.00% |

Lead Managers / Registrars of Waterways leisure tourism

| Lead / Book Running Lead Managers | Centrum Capital Limited, Intensive Fiscal Services Private Limited, Motilal Oswal Investment Advisors Limited |

| Registrar (RTA) | MUFG Intime India Pvt Ltd |

Founding Year of Waterways leisure tourism & Managing Director

It was founded on 2nd November 2020.

Mr. Jurgen Bailom is the Managing Director and CEO of the company.

Waterways Leisure Tourism FAQ

Q1. What is the business of Waterways leisure tourism?

Waterways Leisure Tourism Limited operates luxury multi-destination cruises in India and Southeast Asia through Cordelia Cruises, offering premium hospitality, entertainment, and Indian-centric experiences.

Q2. Why is it raising funds via IPO?

Waterways Leisure Tourism Limited is raising funds via IPO to pay deposits, advance lease rentals, and monthly lease payments for its step-down subsidiary, and for general corporate purposes.

Q3. What is the issue size of Waterways Leisure Tourism and where will it list?

The issue size is approx ₹ 727 crore, to be listed on the BSE SME platform.

Q4. What are the risks to an investor while applying for the IPO?

Limited financial disclosure, weak financials, negative PAT margins.

Q5. What are the potential upsides of investing?

Strong promoter backing and strategic focus on enhancing cruise tourism in India & Operating India’s first multi-destination premium cruise line, Cordelia Cruises to cater a niche luxury market.

Q6. How to apply for the IPO?

Via your brokerage/demat account when the IPO opens (DEC 2025 tentative) and follow usual SME IPO subscription steps (UAN, ASBA, etc).

Q 7. When is the tentative listing date?

Expected listing date is in DEC’25.

For more amazing blogs click here (IPO Corner).

For the latest upcoming IPO Calendar.

For further information you can visit official website of Waterways Leisure Tourism